Is Allowance Taxable in Malaysia

The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. The calculator is designed to be used online with mobile desktop and tablet devices.

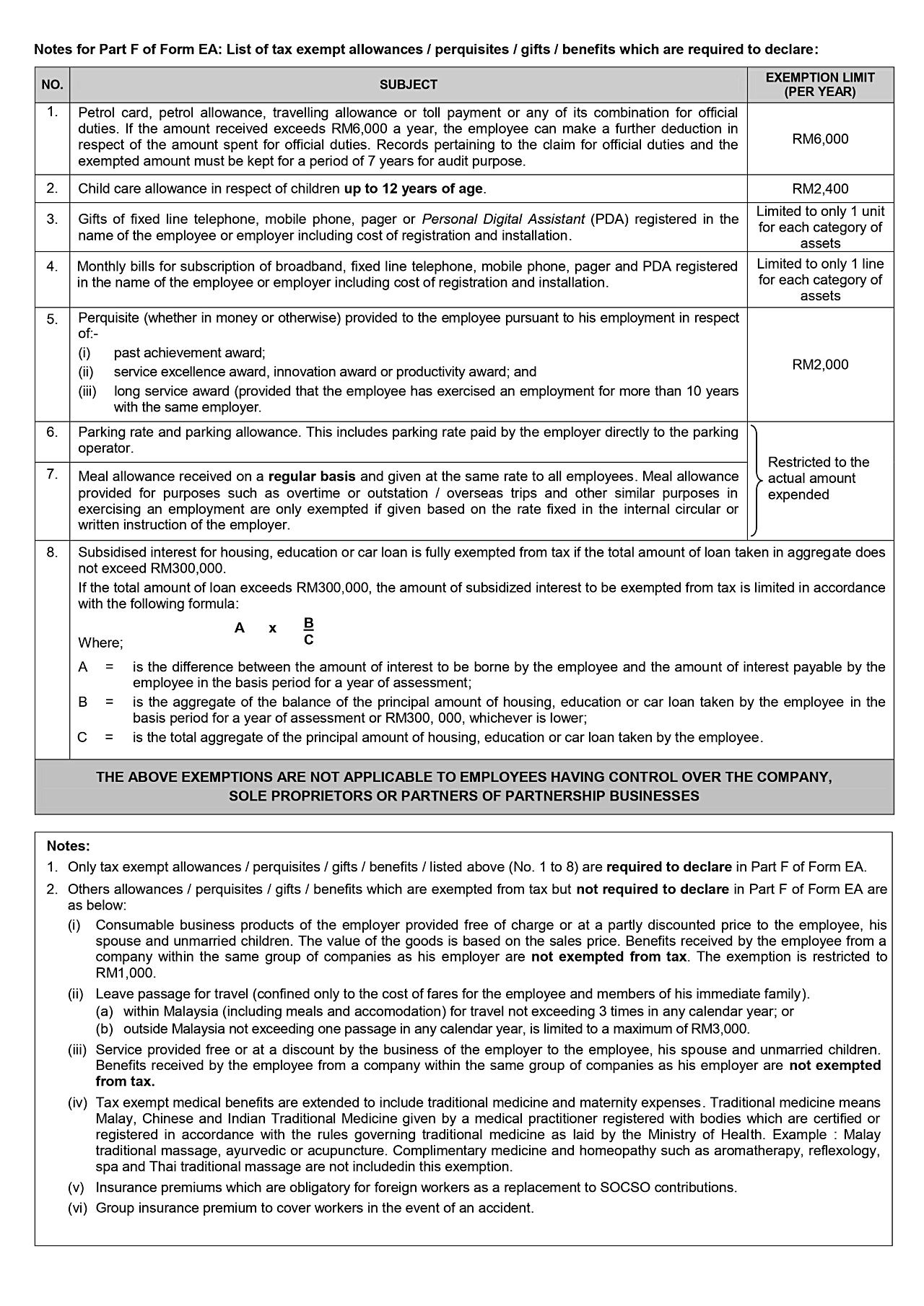

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

Therefore whether you are a Malaysian or a foreign national as long as you reside in Malaysia for less than 182 years in a year any income you earn in Malaysia is taxable under non-resident income tax rates.

. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. In the same way any taxpayer who receives a pension from hisher former employer is entitled to claim the deduction which is the pension amount or Rs40 000 whichever is lesser as per Section 16 of the Income Tax Act. Malaysia has concluded agreements for the avoidance of double taxation agreements with an extensive number of countries.

Loss of personal allowance occurs where income exceeds 100000 and for people claiming the remittance basis as the personal allowance summary explains. One of these deductions is the capital allowances in Malaysia. Capital allowances specifically are capital purchases like the acquisition of land and building that can be claimed as tax deductions.

Youll still need to pay taxes for income earned in Malaysia and will be taxed at a different rate from residents. However to get the reimbursement the employer needs to provide the actual bills to hisher employer. Deductions under Section 16.

A person who is resident in the UK is entitled to a personal allowance regardless of their nationality. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. In Malaysia both a branch and a subsidiary are generally subject to the same tax filing and payment obligations.

This is the. As an experienced Cleantech Energy solutions provider we provide turnkey solutions and services for solar PV system ownership including. The amount that one gets as LTA differs with the employer and the position of the employee in the.

Gains arising from the disposal of capital assets are included in an individuals taxable income but are taxed separately from global income. The Leave Travel Allowance is the allowance provided by an employer to its employees for traveling. This allowance can be utilized while going on a vacation with family or alone.

The pension that a taxpayer gets from hisher former employer is also taxable under Salaries. The taxable amount of business income is what remains after the necessary expenses have been deducted from the gross revenues for the respective year. Not all have been ratified however and not all are comprehensive Local branch.

As in any regular taxation individuals and businesses can claim allowable deductions from their taxable income. Review the full instructions for using the Malaysia Salary After Tax Calculators which details. Certain capital gains are.

The income that is chargeable under. Most of the property. Progressture Solar is an experienced Cleantech Energy Solutions Provider in Malaysia that aspires to green South East Asias power infrastructure as it progresses towards a net-zero emissions scenario.

A person who is UK national can obtain the UK allowance wherever resident.

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

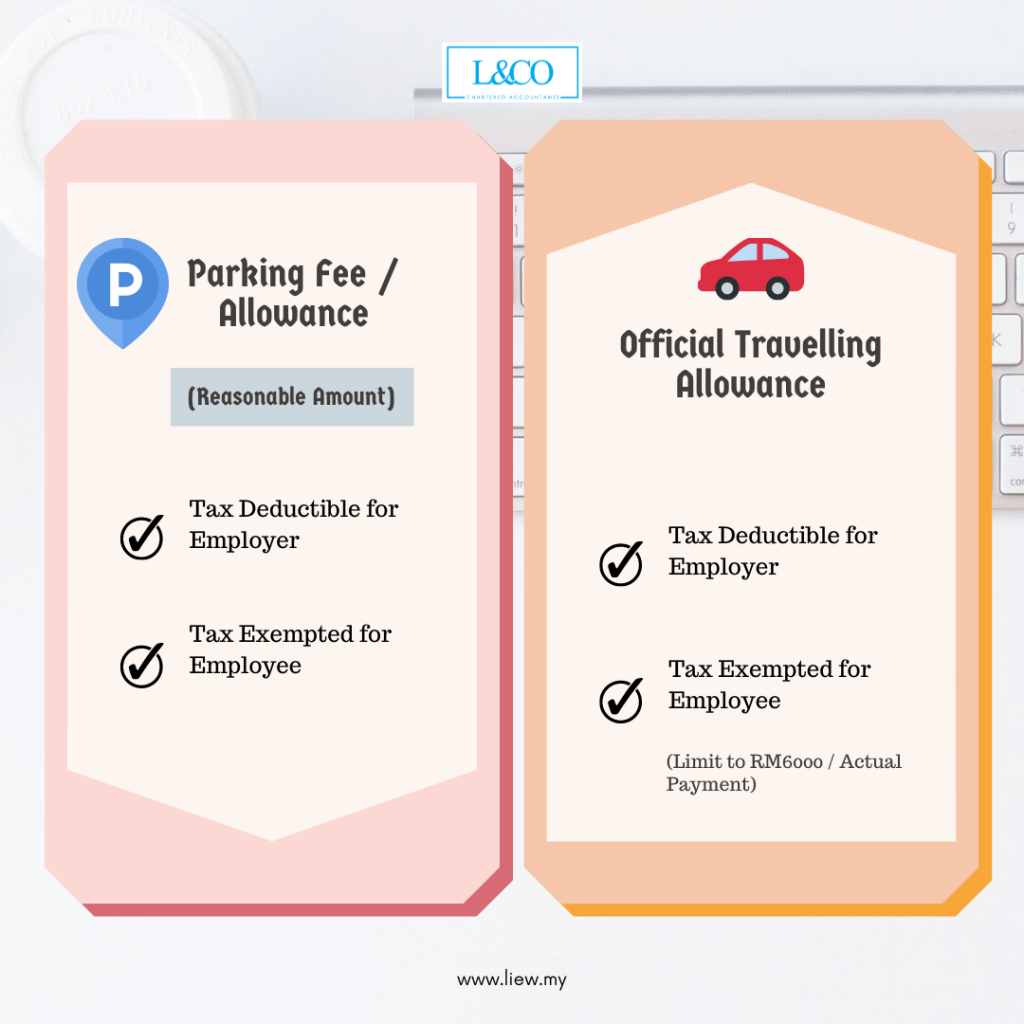

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

No comments for "Is Allowance Taxable in Malaysia"

Post a Comment